Saving! Protection!

?

?is a saving and protection product from Sovannaphum Life Assurance Plc, with flexible policy term, and premium payment term equals to policy coverage term. This product is specially designed for customers who would like to have protection and saving to meet their future financial need or project.

Benefits:

- Receiving cash bonus 5% of sum assured every 5 years through out the policy term and other benefit (if any)(1)

- Receiving up to 140% of sum assured at the end of the policy maturity date(2)

- Receiving 200% of sum assured in case of Death or Total and Permanent Disability (TPD) caused by illness or Accident(3)

Product Feature:

| Insured age | From 5 to 55 years old |

| Expiry age | 65 years old |

| Sum Assured | From $5,000 and above |

| Policy term | 10 to 20 years |

| Premium payment term | Equal with the chosen policy term |

| Premium payment mode | Monthly, Quarterly, Semi-annually, and Annually |

| In case the insured is minor under 18 years old, the partners or guardian must have at least a life insurance policy with sum assured at least equal to the sum assured under this policy. | |

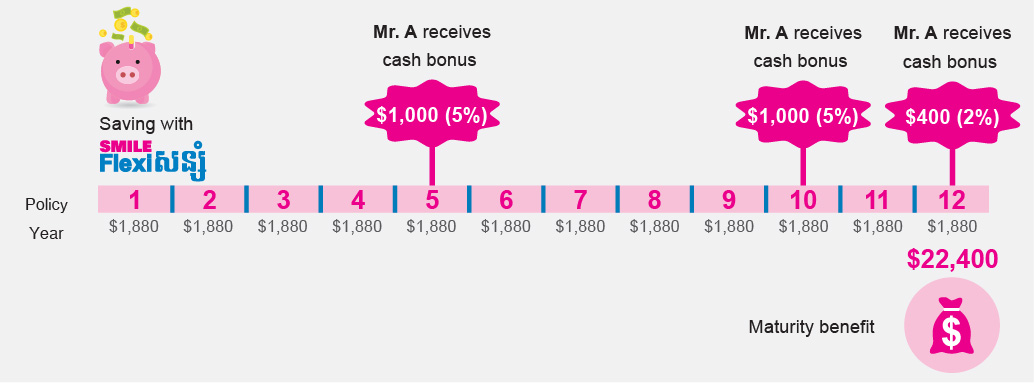

Example:

Mr. A, 30 years old, buys  with the sum assured of $20,000 with policy term 12 years.

with the sum assured of $20,000 with policy term 12 years.

| Premium payment mode | Premium |

|---|---|

| Monthly | $ 171.08 |

| Quarterly | $ 507.60 |

| Semi-annually | $ 977.60 |

| Annually | $ 1,880.00 |

What are the benefits that Mr. A will get?

1. Survival benefits:

- Receiving maturity benefit $22,400 (112% of sum assured) at the end of the 12th year +

- Receiving cash bonus of:

- $1,000 (5% of sum assured) at the end of the 5th year and

- $1,000 (5% of sum assured) at the end of the 10th year and

- $40 (2% of sum assured) at the end of the 12th year

- In conclusion, total benefit receiving by Mr. A is $24,800

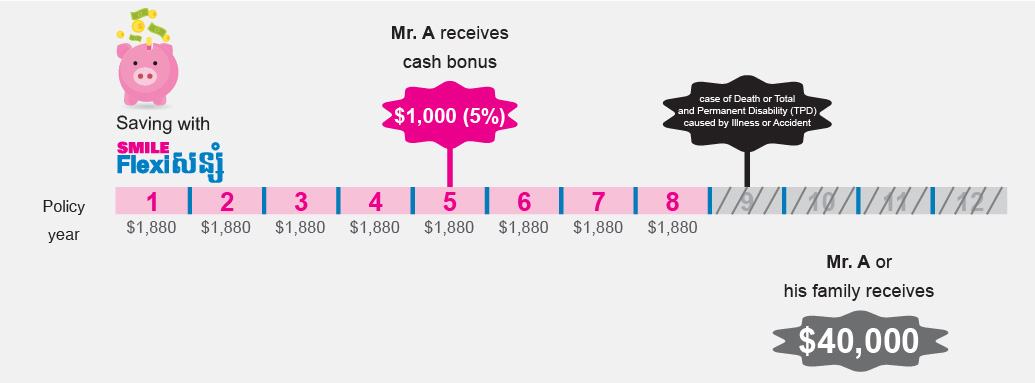

2. Death or Total & Permanent Disability benefits(3)

- In case Mr. A die or get Total & Permanent Disability at year 9th, Mr. A or his family will receive $40,000 (200% of sum assured) for his family immediate need:

- In conclusion, total benefit received by Mr. A or his family is $41,000 of which $1,000 from cash bonus that Mr. A received at the end of the 5th year and $40,000 from the claim settlement of death or Total & Permanent Disability benefit at year 9th.

Exclusions(4)

Death or Total Permanent Disability (TPD) claims results directly or indirectly from any of the following shall be excluded:

a. Suicide or attempted suicide, self-inflicted injury, whether sane or insane within two years after the Policy Effective Date or reinstatement effective date of this Policy, whichever is later; or

b. Committing or attempting to commit by the Insured or the Beneficiary(ies) a criminal offence; or

c. Using drugs or stimulators, abusively using alcohol or driving vehicles under the influence of alcohol as defined in the current laws and regulations.

- (1) For more details please see life insurance contract.

- (2) This benefit is calculated for 20 years policy term and the insured shall survive until the end of year 20th. This policy shall be terminated at maturity date.

- (3) This policy shall be terminated when the benefit of Death/TPD is paid.

- (4) The above exclusions are samples only. For more details exclusions please read terms and conditions.

- Term and conditions apply.

- All information provided in this brochure is for marketing purpose only. For more detail information, please contact our company or Insurance Advisor at bank partners.