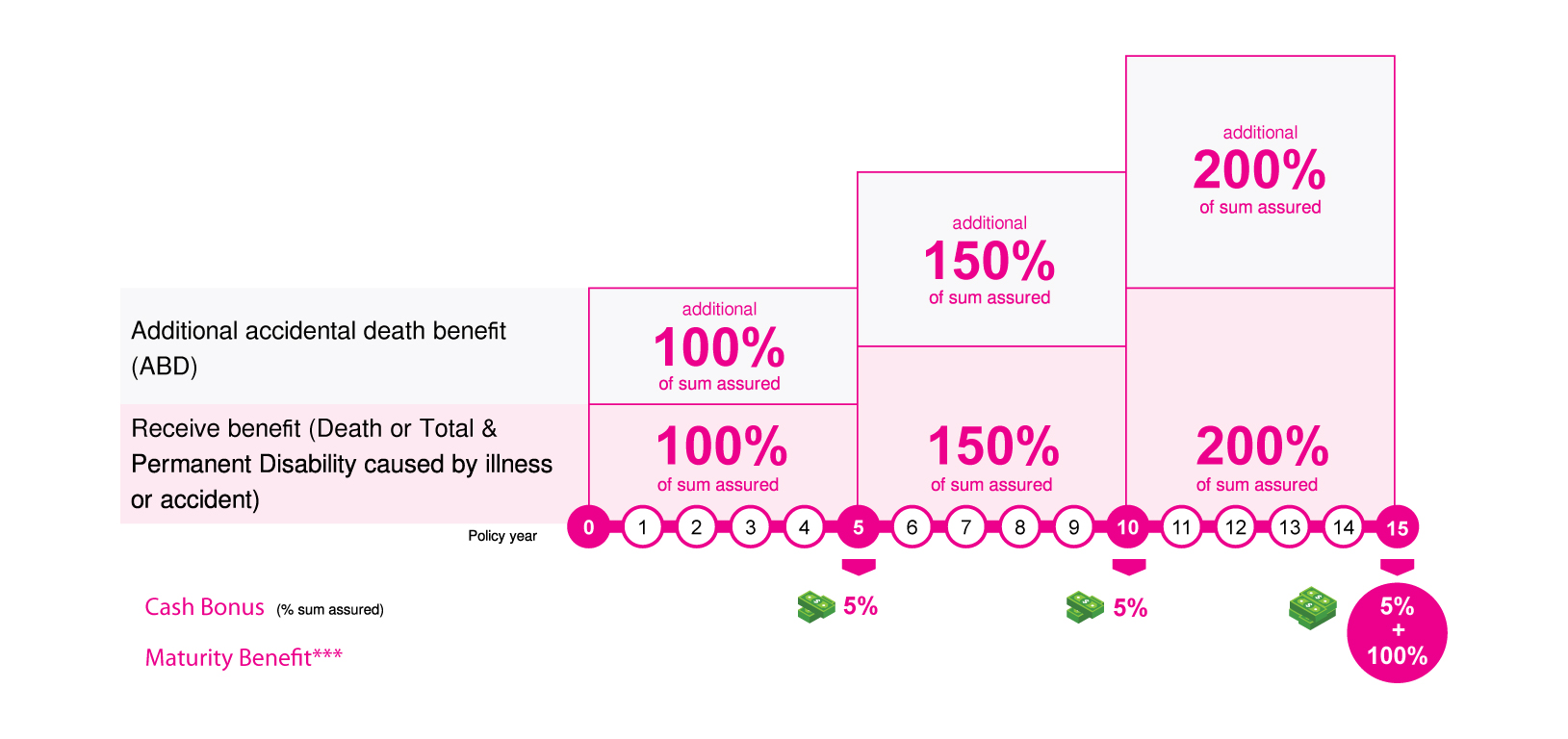

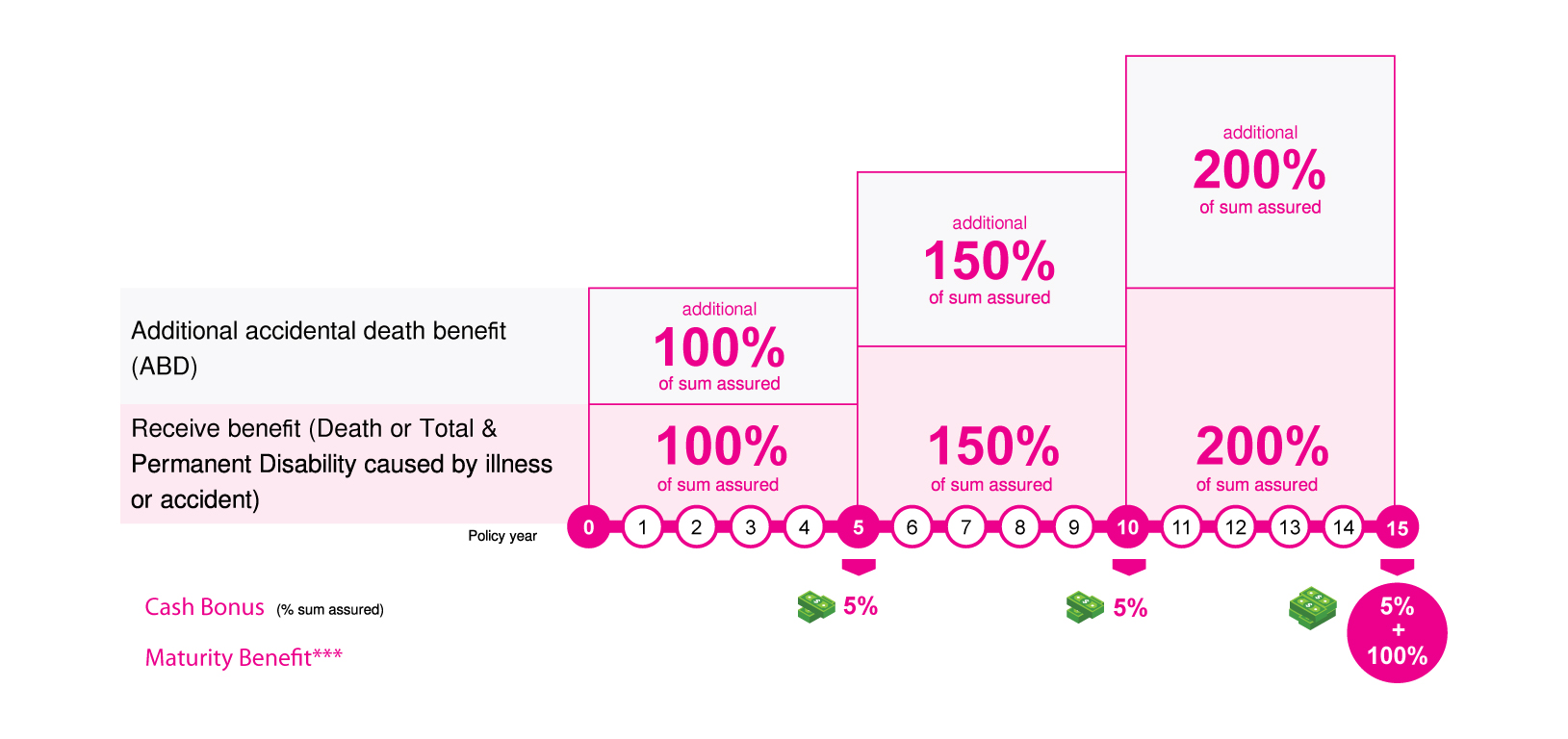

SMILE SUPER Protection and Saving 15/15

ទទួលបានការការពាររហូតដល់ 400%

Benefits

- 1. Receive benefit in case of Death or Total & Permanent Disability caused by illness or accident*

- 2. Receive double benefit in case of death caused by accident*

- 3. Cash bonus of 5% of sum assured payable every 5 years until the end of the policy term**

- 4. Maturity benefit payable at the end of policy term***

- 5. No premium increment for entire policy term

Products Features

| Insured Aged | From 18 to 50 years old |

| Policy term | 15 years |

| Premium payment term | 15 years |

| Premium payment mode | Monthly, Quarterly, Semi-annually, and Annually |

| Sum assured | From $4,000 |

Example

Mr. A age 30 years old purchased SMILE SUPER Protection & Saving 15/15 with $10,000 sum assured.

| Premium payment mode | Premium |

|---|---|

| Monthly | $ 63.54 |

| Quarterly | $ 188.50 |

| Semi-annually | $ 363.10 |

| Annually | $ 698.20 |

What are the benefits that Mr. A will get?

Scenario 1

- Assume that Mr. A successfully completes his saving plan and survives at maturity date (the end of year 15th)

- Mr. A will get the Maturity Benefit*** and Cash Bonus as follows:

- 1. Cash bonus of $500 payable every 5 years (total is $1,500), and

- 2. Maturity benefit of $10,000 payable at the end of the year 15th (100% of sum assured)

- Mr. A will get in total $11,500

Scenario 2

Assume that there is an unfortunate event happen to Mr. A in year 11th, the benefit provided will be according to each case as follows:- 1. In case of Total and Permanent Disability (TPD) caused by illness or accident

- Mr. A will get $20,000 and the policy will be terminated. or

- 2. In case of Death caused by illness:

- Mr. A’s family will get $20,000 and the policy will be terminated. or

- 3. In case of Death caused by accident:

- Mr. A’s family will get $40,000 and the policy will be terminated.

- *This policy shall be terminated when the benefit of Death/TPD is paid

- **This benefit will be paid of the end of year 5, 10 and 15 if there is no Death/Total & Permanent Disability (TPD) claim happens during the policy term.

- ***This benefit will be paid if the insured survived till the end of the policy year and there is no Death/ Total & Permanent Disability (TPD) claim happens during the policy term.

- All information provided in the brochure is for marketing purpose only. For more details, please contact our company or sale staff.

- Terms and conditions are applied.